(WJW) – Planning your holiday shopping and how you’ll finance it?

Walmart recently announced that the company is scrapping its layaway plan just before the holiday shopping season, and instead switching to a “buy now, pay later” program in partnership with lending company Affirm.

The company, which recorded a total revenue of $559 billion in 2020, says this alternative to layaway allows customers to purchase products immediately and pay over time.

Which items can customers purchase under this new plan?

“We’ve learned a lot in the past year as our customers’ needs and shopping habits have changed,” a representative for Walmart said in a statement. “Last holiday season, we removed seasonal layaway from most of our stores with the exception of select jewelry items at select stores, and based on what we learned, we are confident that our payment options provide the right solutions for our customers.”

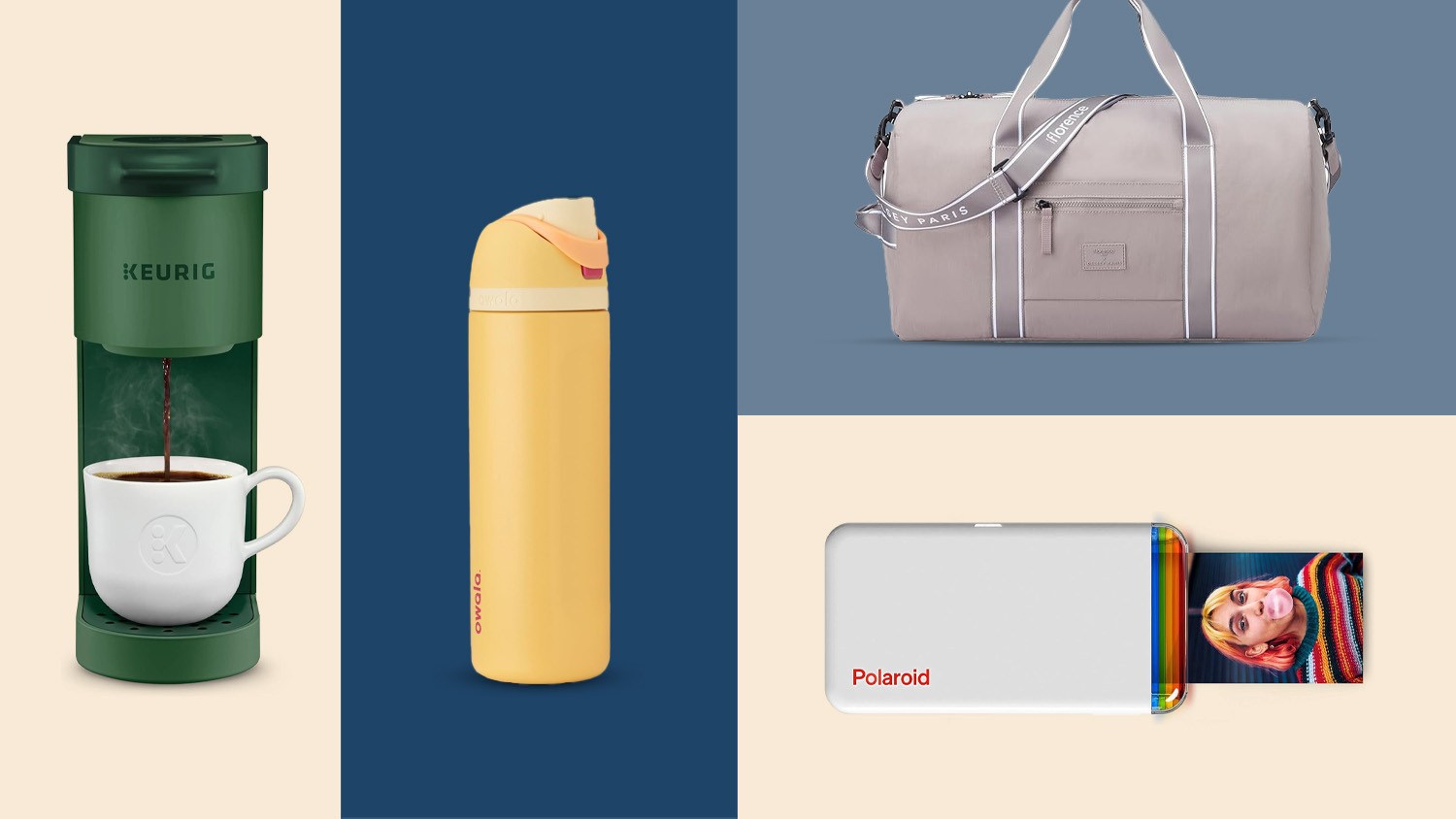

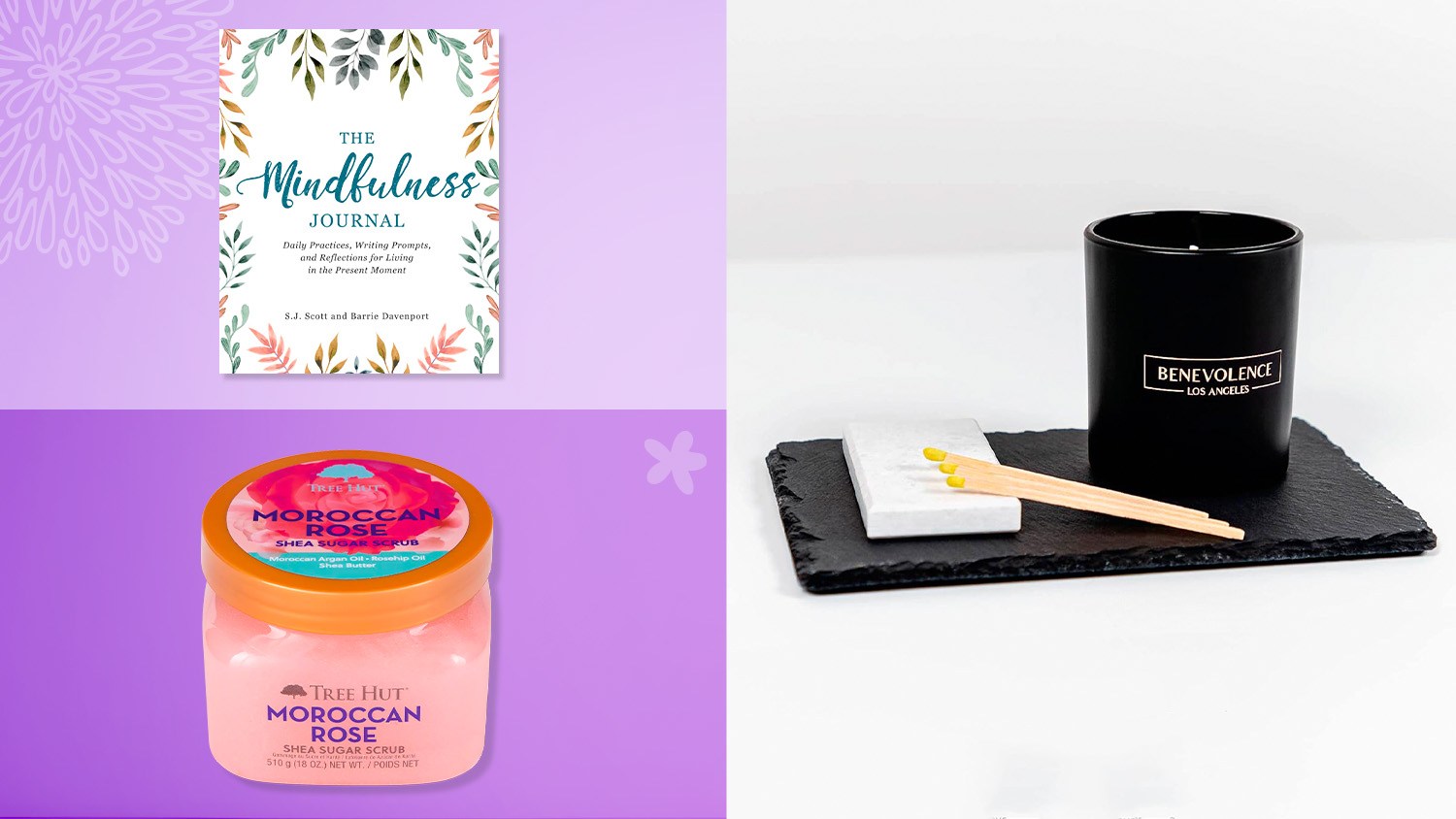

Eligible categories include electronics, toys and home; ineligible items are alcohol, gasoline and pet supplies. A complete list of categories eligible for financing is available at Walmart’s official site.

How long will customers have to pay it off?

Depending on what’s in the cart, shoppers can finance purchase for as little as 3 months or as long as 24 months. For cart totals between $144–$799.99, customers may be able to finance purchases over 3, 6, or 12 months. For carts between $800–$2,000, purchases can be paid over 12, 18, or 24 months. All payment options are subject to eligibility.

Payments can be made or scheduled at Affirm.com or in the Affirm app for iOS or Android.

How much is the annual percentage rate?

Zero-percent APR is the promotional financing for only certain Walmart.com products, and for a limited time. For other items, the APR rate is between 10–30%, depending customers’ credit. The rate will appear in the Affirm app upon checkout.